New England Sports Ventures (NESV) today announces that it has completed the purchase of Liverpool Football Club.

NESV wishes to extend its sincere gratitude to the Board of Liverpool FC for their diligence and their efforts on behalf of the Club and its supporters.

NESV wishes to extend its sincere gratitude to the Board of Liverpool FC for their diligence and their efforts on behalf of the Club and its supporters.

The transaction values the Club at £300m and eliminates all of the acquisition debt placed on LFC by its previous owners, reducing the Club's debt servicing obligations from £25m-£30m a year to £2m-£3m.

New England Sports Ventures is committed to winning and currently owns a portfolio of companies, including the Boston Red Sox, New England Sports Network, Fenway Sports Group and Roush Fenway Racing.

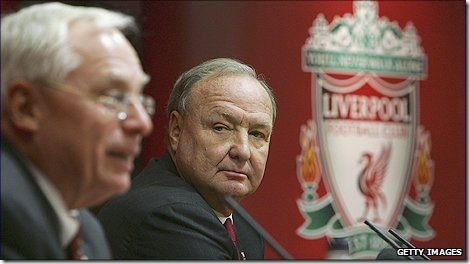

Liverpool’s drawn-out sale to the owners of the Boston Red Sox was completed Friday after a bitter trans-Atlantic court fight over English football’s most successful club with the previous American owners.

“We are committed first and foremost to winning,” said John Henry, the financier who heads NESV. “We have a history of winning, and today we want LFC supporters to know that this approach is what we intend to bring to this great club.”

“As every Liverpool fan knows, the most nerve-racking way to win a match is by a penalty shootout,” - said club chairman Martin Broughton, referring to Liverpool’s fifth European Cup triumph against AC Milan in 2005.

The sale finally went through after Hicks and Gillett withdrew the temporary restraining order blocking the sale they had obtained in a Texas court. Later, they also dropped their claim for $1.6 billion in damages.

“The most important thing is that NESV have cleared us of all the debts which, frankly, shouldn’t have been on the club in the first place.”

“All that huge amount of money that our fans spend supporting our team, coming to games and all the other activities is now available for what it should be available for, to invest.” - managing director Christian Purslow.

Henry insisted that NESV’s deal wasn’t a leveraged buyout. The acquisition debt has been eliminated and the cost of servicing the club’s debt has slumped from $40 million to $48 million a year to $3.2 million to $4.8 million.

Amid the takeover turmoil, Liverpool is mired in the relegation zone after its worst start to a league season since 1953. Henry said it was too early to decide on specific plans, but noted the Red Sox are the second-highest spending club in baseball. Liverpool manager Roy Hodgson expects to have cash to spend in the January transfer window to strengthen the struggling team.

“In future we can invest in players in a different way,” – Roy Hodgson.

Source: LiverpoolFC.tv

Stay tune for more news and follow me on Twitter.

In a statement released by Liverpool FC official website yesterday,

In a statement released by Liverpool FC official website yesterday,  Mr Justice Floyd had earlier upheld the claim by RBS for breach of contract against Hicks and Gillett after they attempted to block the sale last week by dissolving the board, contravening an agreement signed as a condition of refinancing last April that also led to the appointment of Broughton. The QC representing Hicks and Gillett had said in court that the pair accepted their time as owners of Liverpool had come to an end but that they believed the club was worth more than it was being sold for.

Mr Justice Floyd had earlier upheld the claim by RBS for breach of contract against Hicks and Gillett after they attempted to block the sale last week by dissolving the board, contravening an agreement signed as a condition of refinancing last April that also led to the appointment of Broughton. The QC representing Hicks and Gillett had said in court that the pair accepted their time as owners of Liverpool had come to an end but that they believed the club was worth more than it was being sold for.